The child tax credit parent plus checks?! Then, your amended return will be added to the 18.2 million unprocessed returns. There’s only one way to do this: by mail. The IRS will notify you of the error by mail, and you’ll have to send in Form 1040X. If you made an error that requires an amended return, your tax season will be even more prolonged.

#Irs.gov refund status manual

Paper returns require manual processing, so if you’ve filed by paper, expect a long wait, even if there are no issues with your return.

#Irs.gov refund status verification

About 18% of those flagged for identity verification took longer than 120 days. But about 25% of returns flagged for income verification took 56 days or more to process in 2020. Most returns flagged for fraud don’t turn out to be fraudulent. IRS fraud filters flagged about 5.2 million returns for 2020, according to the Taxpayer Advocate Service. If the IRS suspects fraud involving your return, you could also be in for a long wait for your refund - which has been a growing problem for taxpayers.

The IRS could take your refund and use it to offset what you owe if you owe certain types of debt like child support or back taxes, Your refund will also be delayed if you made an error or your return was incomplete. For example, if your refund was sent to a bank account that you’ve since closed, the IRS will eventually cut you a paper check, but that adds to the wait time. These situations also require a manual review.īut your tax refund could also be delayed for all the reasons that would apply in a normal year. Or if you had a child in 2020, you’d get stimulus credits on their behalf. For example, if your 2019 income was higher than your 2020 income, you may qualify for more stimulus money. The same applies if you’re eligible for stimulus money from the first two checks based on your 2020 return that you didn’t qualify for based on your 2019 or 2018 return.

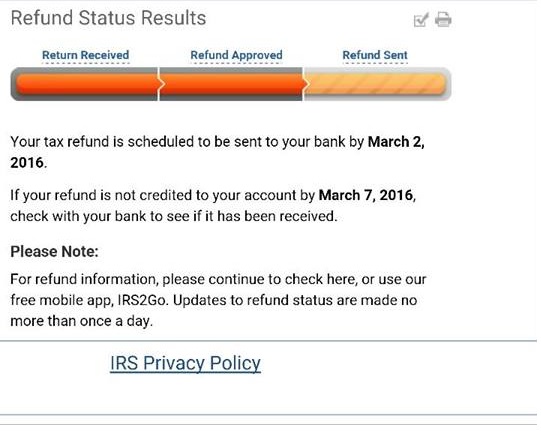

#Irs.gov refund status update

However, the IRS didn’t have time to update its programs to reflect this change, so if you’re seeking the Earned Income Tax Credit based on 2019’s income, an IRS employee will need to manually review it. The $900 billion stimulus package that passed in December changed the rules to allow families to use 2019 income to qualify instead of 2020 income. These challenges prompted the IRS to extend the tax deadline to May 17.įor example, people who typically qualify for the Earned Income Tax Credit, a credit for low- and middle-income working families, may not have been eligible in 2020 due to expanded unemployment benefits. Plus, tax season started 16 days later than usual this year. Along with the usual tax season mayhem, the IRS was tasked with delivering the third stimulus check. There were a number of complexities created by the three stimulus bills, the most recent of which passed in the middle of tax season. The 2020 tax season was an especially complicated one for IRS staff and accountants. But if you’re still waiting and wondering “where is my tax refund?”, here’s what’s going on and how you can track it. To be clear, most taxpayers who e-file had their returns processed and received their refunds within 21 days, according to the IRS. Many require manual processing, which basically means that a human needs to review it.

Chances are you got your third stimulus check months ago, but you may still be waiting on that other chunk of change the IRS owes you: your tax refund.Īs of June 5, the IRS is sitting on a backlog of 18.2 million individual tax returns.

0 kommentar(er)

0 kommentar(er)